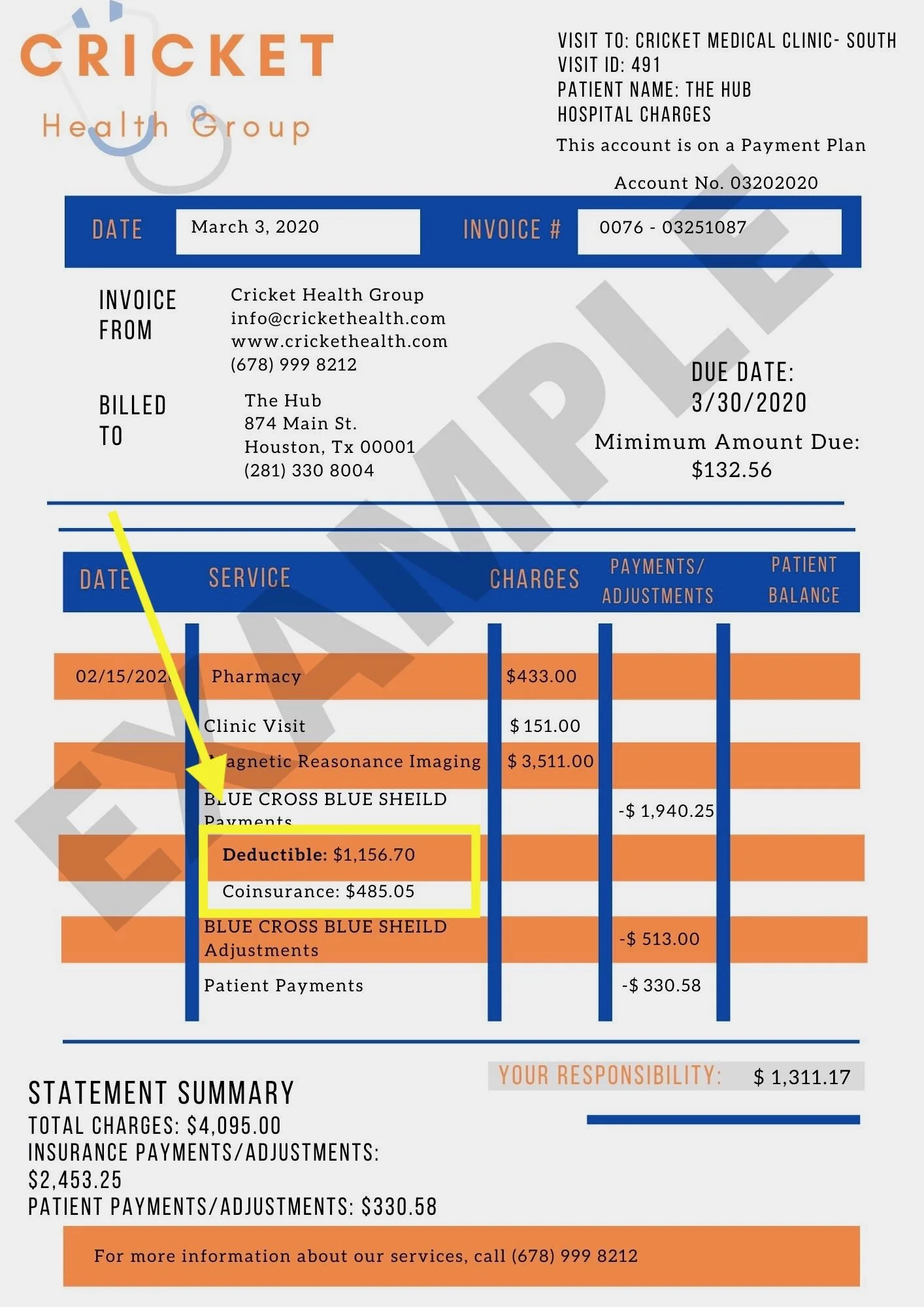

Deductibles

A deductible is the amount you are expected to pay in full before your insurance steps in to share the cost. For example, if your plan lists a $2,000 deductible, you are expected to pay the first $2,000 in medical expenses yourself. After spending that $2000, any other expenses will be split with your insurance company. This percentage is called coinsurance.

This does not mean that you are expected to pay all medical expenses up to $2,000. Certain types of doctor visits are fully paid by insurance company even prior to meeting the deductible. These are mostly preventative services, such as annual physicals and testing.

Co-pay

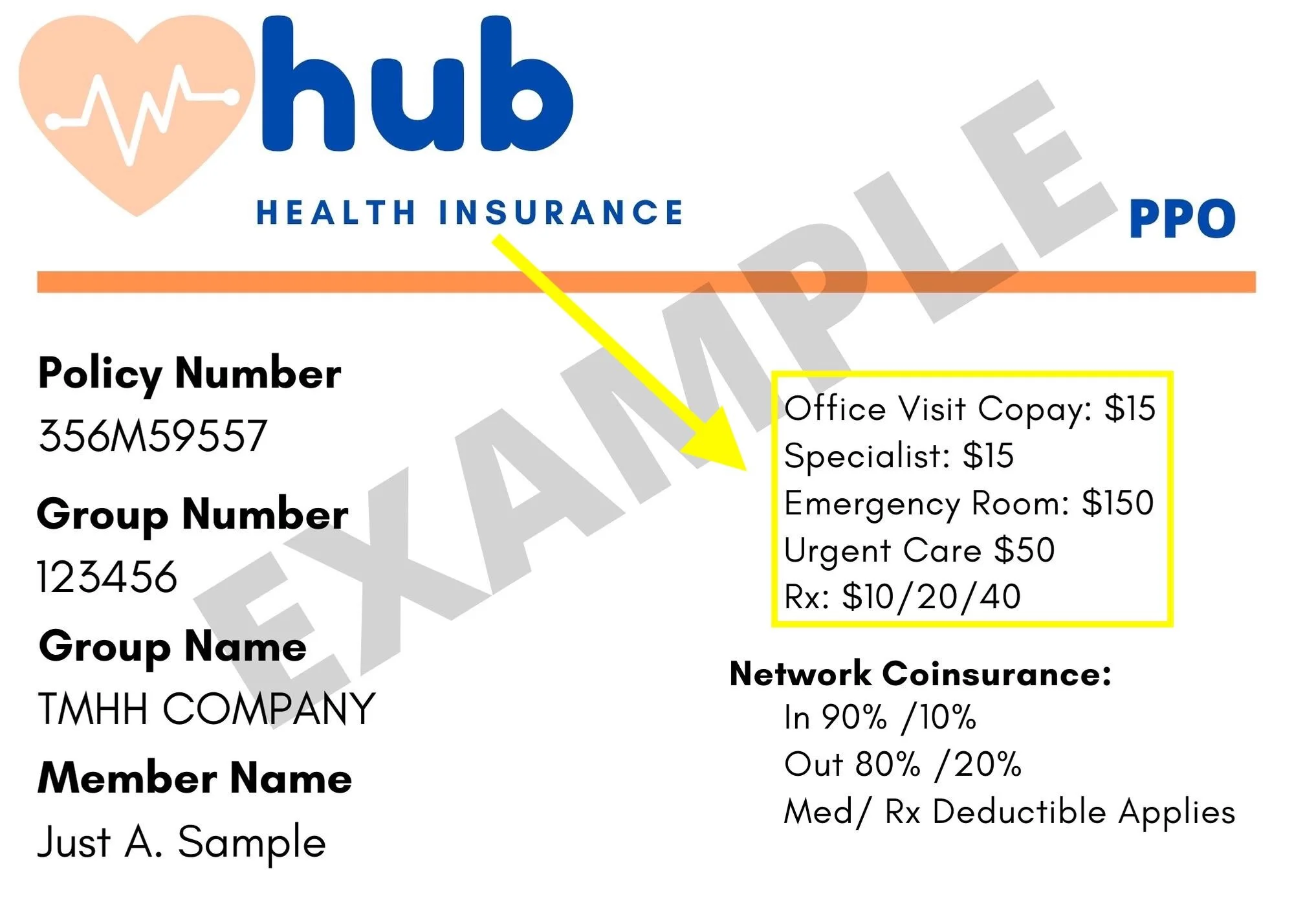

Insurance plans will indicate the copay needed for various medical appointments. This is the amount you will need to pay at most appointments regardless of if you have met your deductible or not. Copays can be categorized into standard office visits, specialist visits, ER visits, and urgent care visits.

Again, not all appointments require a copay. This includes preventative visits such as annual physicals or pap smears.

In vs. Out of Network

Another thing to keep in mind, is whether the expert you choose to visit is in or out of your insurance plan’s network. This determines the cost of your appointments. If you are unsure, always call the office to ask if the doctor is in your network.

Since we are Houston-based currently, we do want to note that United Healthcare has classified Houston Methodist to be out of network as of January 1, 2020.

PPO vs HMO vs etc

Health Savings Account (HSA)

Short-term Disability & FMLA

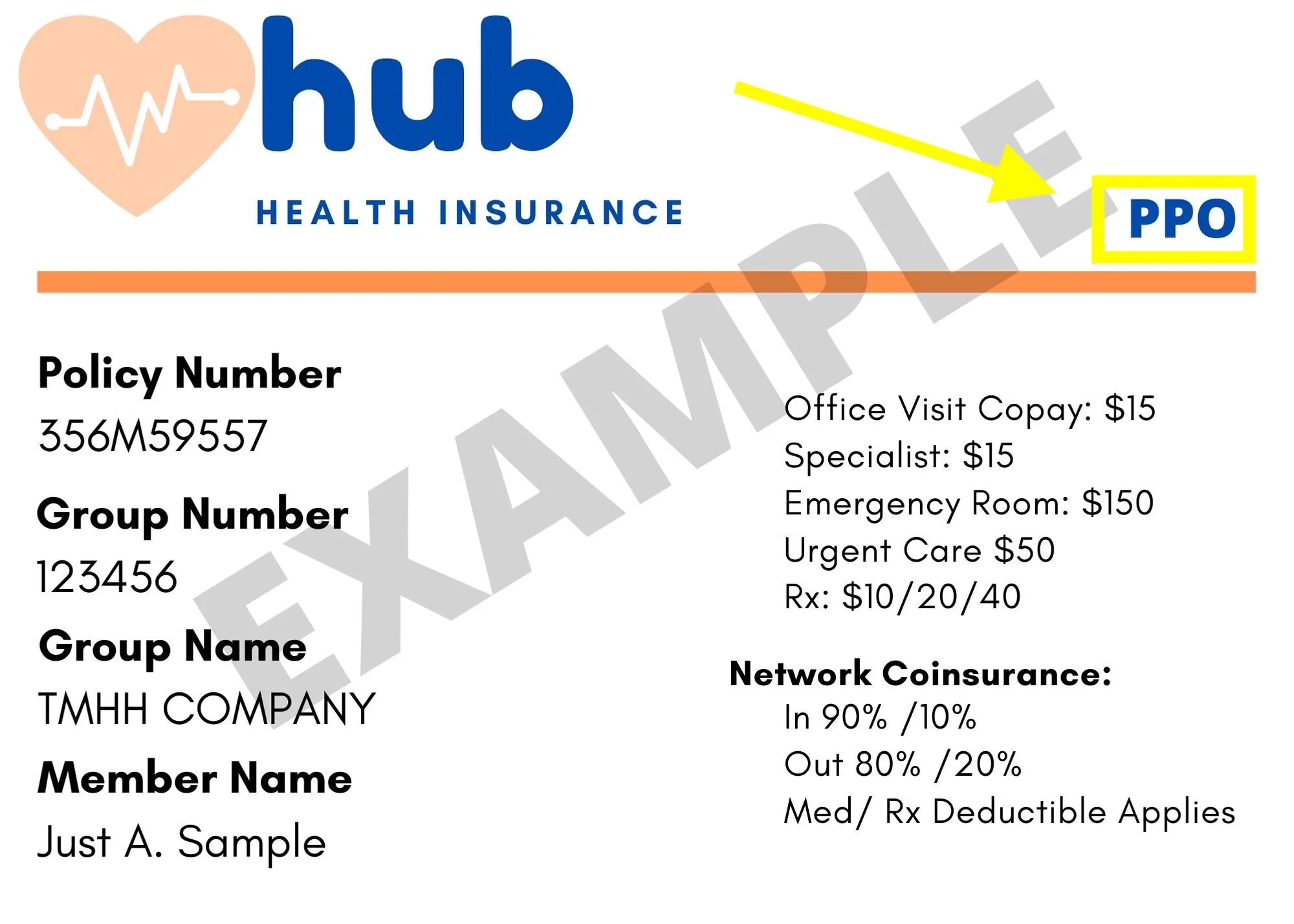

Preferred Provider Organization (PPO):

If you have a PPO insurance plan, this means that you will pay less for health visits to providers listed on your specific plan. This is where ‘in’ or ‘out of network’ comes into play. A visit to a doctor outside of your insurance plan’s network will cost more.

Point of Service (POS):

This type of plan requires a referral from your primary doctor for any speciality appointments. These specialists must be a part of your insurance’s network.

Health Maintenance Organization (HMO):

This type of plan only covers visits to specialists in a contract with your HMO. This HMO network consists of doctors who have agreed to lower costs for plan members. These plans will generally not cover outside care, unless in the case of emergency. Premiums and deductibles tend to be much lower than other plans on an HMO. However, you will pay the full medical costs of any visits outside of the HMO network.

High Deductible Health Plan (HDHP):

This type of plan has a lower monthly cost than traditional plans. However, as the name suggests, the deductible is much higher than normal. You save money if you have few doctor visits in a year.

If you are struggling with severe mental illness that interferes with your ability to work, there are a few options available for taking time off to obtain the proper help.

While searching for an insurance plan right for you, you may come across a Health Savings Account (HSA) option through your employer. An HSA is a savings account specifically for health care costs. The funds placed into this account remain untaxed and can be used exclusively to cover medical bills.

Short-term Disability

Depending on your insurance, you may have access to short-term disability coverage. However, it is only mandatory to be offered in five states: California, Hawaii, New Jersey, New York, and Rhode Island. You will need to review your plan to determine if you are covered.

If you are covered, mental illness can be considered a disability. You will need to visit a psychiatrist and they will help determine your eligibility. They will provide you will the necessary documents for your leave. Your plan will also tell you how much time you can take off.

Your plan will also determine what percentage of your usual paycheck will be paid out to you while you are on leave. This allows you to heal at home without worrying about bills.

Note however that there are no laws in place protecting your position for you while you are on short-term disability. However, due to the American’s with Disabilities Act, your company must first show that they have attempted to provide any accommodations possible to allow you to continue to perform the job. Legally, you cannot be fired due to a disability.

Family and Medical Leave (FMLA)

This act provides up to 12 weeks leave of unpaid job protection. You are eligible if you have been employed at your employer for at least 12 months. This does protect your employment. Legally, an employer cannot hire anyone new for your position. The only loophole is if the company eliminates your position all together.

Private employers with less than 50 employees do not need to provide FMLA. This refers to the number of employees per office. If you work for a national company but your office employs less than 50 people, you will need to check if you are offered FMLA.

Disclaimer: We are not mental health providers.